Helicopter heavyweight fills the oil and gas gulf

Gulf Helicopters is continuing to enjoy phenomenal growth in terms of flying hours, helicopter numbers and revenue. Captain John Toon explains why to Jon Lake.

Qatar’s Gulf Helicopters was the first major helicopter operator in the Gulf region and it remains one of the largest and most highly regarded.

The company was established in July 1970, when Gulf Aviation, BOAC, and BEA owned it jointly.

Gulf Helicopters became a wholly-owned subsidiary of Gulf Air in March 1977. In 1998, when Gulf Air decided to sell off its non-core businesses to focus on its core airline operation, Gulf Helicopters was taken over by Qatar Petroleum. Since February 2008, the company has been owned by Gulf International Services QSC (GIS), a Qatar-based public shareholding company 30 per cent owned by Qatar Petroleum.

Supporting offshore oil and gas activities currently accounts for some 95 per cent of Gulf Helicopters’ activity, with only a relatively small number of short-term, ad hoc contracts onshore.

Mohammed Al Mohannadi sees little prospect of further business use of helicopters in the region with regulations, security concerns and a lack of heliports ensuring that most flights will have to be between existing airports, except in the case of occasional head-of-state VVIP operations.

Gulf Helicopters’ Air Operators’ Certificate only permits offshore operations, with separate permissions being required for onshore flights. The recession had an impact on the oil and gas industry and Mohannadi acknowledged: “We won’t see further increases in oil and gas.”

This, Mohannadi said, has made Gulf Helicopters “work hard to look at other areas”, to open up new markets, to work harder to find work for the company’s helicopters and to look at other means of achieving growth.

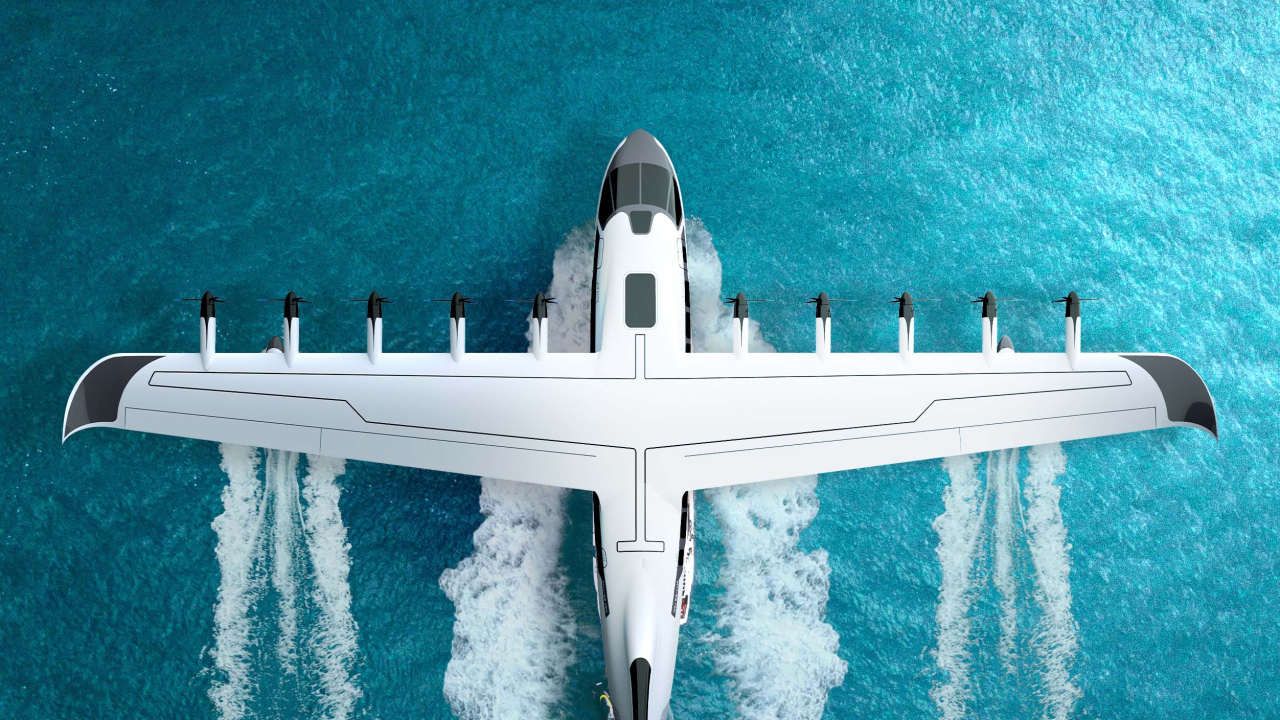

The company always tries to be ahead of the game and is looking at launching a seaplane operation in the next few months, using a Cessna Caravan floatplane. It is developing other activity areas to sell services to third-parties, including maintenance and training.

The company is working hard to gain international accreditation and recognition for its services. It is already sub-contracted by Sikorsky to provide some S-92 support, and is supporting the Qatar Emiri Air Force as it brings its own AW139 helicopters into service.

Already accredited as an IASA 147 training organisation, Gulf Helicopters’ Training Academy has been spun off as a wholly-owned but separate entity, and trains personnel for the parent company and third-party operators. This element of the business will become progressively more important, especially once the company’s new AW139 simulator is fully up and running, as it expects third-party demand for this to be heavy.

Today, Gulf Helicopters has a fleet of some 37 helicopters, comprising 12 AgustaWestland AW139s (five more remain to be delivered), 19 Bell 412s, four Bell 212s and a pair of Sikorsky S-92s. The company manages three further aircraft, including a VVIP-configured Eurocopter EC155, based in Europe, and an MD902 Explorer used for helicopter emergency medical services (HEMS) tasks on behalf of the Hamid Hospital in Doha since 2007. The company has evaluated larger helicopters for offshore use, including the S-92 and Super Puma, since these would give a longer range and higher payload capability, and has talked to Eurocopter about its new EC175, and to Agusta and Bell about stretched derivatives or variants of the 412 and AW139.

It has, however, allowed its three Bell/Agusta BA609 tilt rotor options to lapse, after a serious re-evaluation of requirements.

The company does not restrict its operations to Qatar and is currently operating in East Timor, India (in a joint venture with the United Helicopter Company), Libya, Oman, Saudi Arabia and Yemen. Libya has been especially important for Gulf Helicopters and the company was coming to consider it as a North African hub.

Most of the company’s operations in these countries are in support of oil and gas exploration/exploitation but also include some VVIP transport, onshore transport, seismic support, load lifting and photo flights, as well as the provision of air ambulance and HEMS.

The company is also believed to be considering responding to a tender in Algeria that would require about 15 helicopters and that would include EMS, fire-fighting, crop dusting and power line inspection and washing, and has bid for offshore oil and gas contracts in both Italy and the UK.

Once a company largely made up of expatriate European, American and Australasian personnel, Gulf Helicopters is becoming increasingly Qatari, as it follows a similar ‘Qatarisation’ plan to that being pushed forward by its Qatari Petroleum parent company, which demands 50 per cent local staff within five years.

Progress will naturally and inevitably be more slow when it comes to helicopter pilots and engineers, though the company already claims to have reached 23 per cent local pilots/engineers, with some 90 local co-pilots, 110 local engineers and 6-7 Qatari captains.

The company had just three local Qatari pilots as recently as 2000, yet looks set to hit the 50 per cent target within two-to-three years, according to Captain John Toon, Gulf Helicopters chief pilot. Most will be co-pilots, but also include the chief pilot responsible for special operations (VVIP flying), the deputy chief pilot for operations, and the deputy chief training pilot.

Stay up to date

Subscribe to the free Times Aerospace newsletter and receive the latest content every week. We'll never share your email address.