Baghdad's long haul to Europe

As the only Iraqi member of IATA, Fly Baghdad plays an outsized role in connecting the Gulf state to the world. Chief executive Basheer Al-Shabbani talks about the airline’s plans for the future.

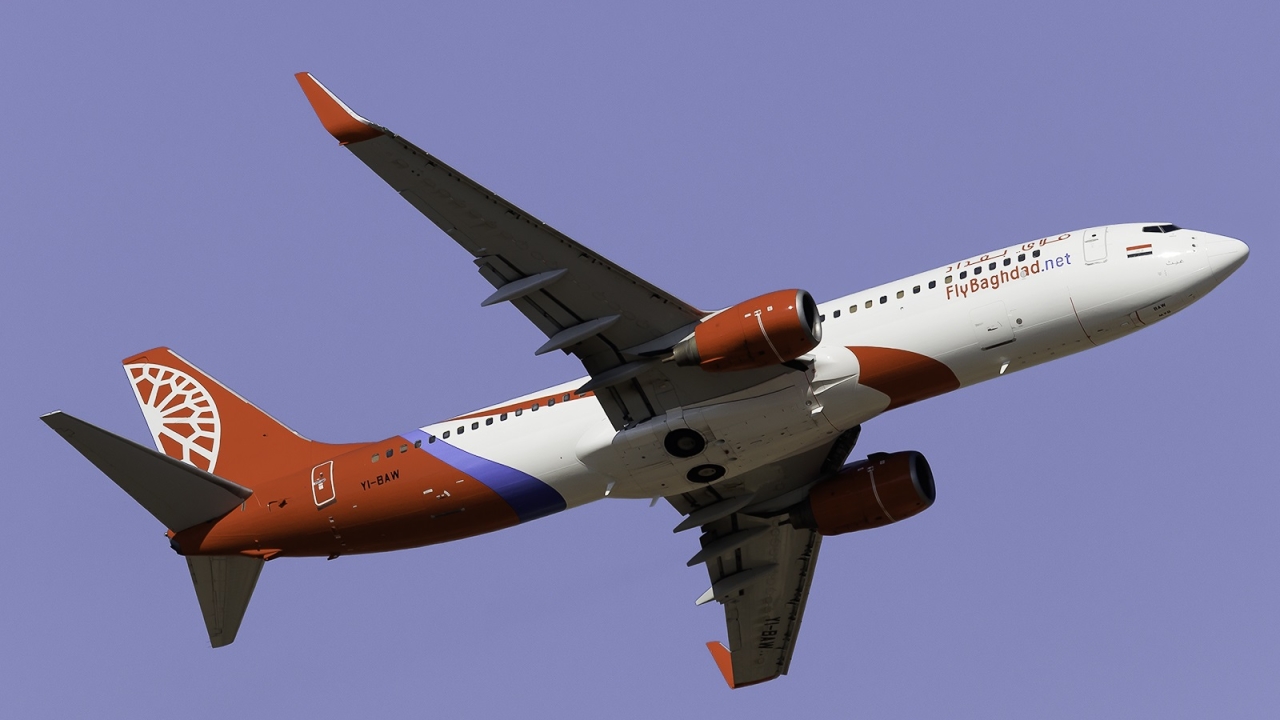

Fly Baghdad aircraft set to soar. PICTURE: Maik Voigt

Back in 2013, Saad Al-Khafaji, the then director general of Iraqi Airways, beamed from cheek to cheek while talking to Arabian Aerospace about the coming “tsunami” in Baghdad.

Unfortunately, the surge in tourism and business traffic predicted by Al-Khafaji never materialised – replaced, instead, by a brutal Daesh insurgency that would paralyse Iraq and the Middle East for years. The devastating fallout of that conflict continues to this day. But, with security now largely restored, hopes are rising once again that Baghdad will rehabilitate its image on the world stage.

And, while the flag-carrier has succeeded in doubling its fleet and rebuilding much of its pre-war network, it’s the private sector that’s arguably taken the biggest strides forward for civil aviation.

Fly Baghdad launched as a charter airline in 2014, hoping to share in the spoils of Iraq’s economic growth after the overthrow of Saddam Hussein and the normalisation of bilateral ties around the world.

The airline was forced to suspend operations just two years later as its home nation teetered on the brink of civil war. But, even with Daesh holding onto territory in the north and perpetrating ever more deadly terror attacks, Fly Baghdad’s owners sensed an opportunity to try again.

Prominent Iraqi businessman Ahmad Asad decided to reinvent the company as a scheduled airline – initially adopting a low-cost carrier business model – and flights resumed in February 2017.

Within 10 months, Iraqi troops had liberated the last remaining towns under Daesh control and prime minister Haider Al-Abadi had publicly declared victory over the terrorists.

The gamble, in other words, paid off.

"We are not, any more, a low-cost carrier," Basheer Al-Shabbani, Fly Baghdad’s chief executive, said in an interview in June.

“The concept started as a low-cost carrier targeting people who cannot pay for luxury tickets. But, when I took over as CEO in 2018, I found the Iraqi people don't like the name ‘low-cost’. They don't like having a ticket without having some extra service on board … So now we are providing almost all the services free: passengers on Fly Baghdad have the meals free, first-time [booking] changes free, 25kg [checked] baggage, 7kg hand luggage. So it's similar to Iraqi Airways.

“Indeed, you can call us a low-fare carrier. We depend on the high density of seats to give us the opportunity to sell a low ticket [price] to get the revenue.”

Despite its relative youth, Fly Baghdad has quickly become the second largest airline in Iraq with 10 aircraft on its registry: five Boeing 737-800s, two 737-900ERs, one 737-700, one Bombardier CRJ200 and one CRJ900.

A third 737-900ER was expected to join the fleet by the end of the July, Al-Shabbani confirmed, pending the completion of a C-check in Cairo.

By way of comparison, Iraqi Airways has 37 aircraft on its registry – including three widebodies – though only about half of the planes are currently in service. The flag-carrier took delivery of its first Boeing 787 Dreamliner in June, with nine more on order.

Eager to attract more corporate travellers, Fly Baghdad has installed business class cabins on two of its Boeing 737-800s – currently deployed on the Dubai and Beirut routes – as well as on the newly-inducted Bombardier CRJ900.

Other points in the route network include Ahmedabad and Mumbai (India); Aleppo and Damascus (Syria); Amman (Jordan); Cairo (Egypt); Isfahan, Mashhad and Tehran (Iran); Istanbul (Turkey); Karachi and Lahore (Pakistan); Medina (Saudi Arabia); Tunis (Tunisia); and Yerevan (Armenia).

Most flights depart from Baghdad, though several point-to-point services are operated from secondary bases Erbil and Najaf. There are also less frequent flights from Kirkuk and Basrah.

Plans for a Moscow route have now been dropped, Al-Shabbani confirmed, while Dammam in Saudi Arabia is lined up to be the next regional addition.

Asked about the prospects of further expansion, the chief executive said Fly Baghdad’s narrowbody fleet needs to grow “at least 30%” to satisfy existing demand. That includes the planned introduction of a 737 converted freighter for regional deployment.

But a bigger prize awaits the airline if it can tap into longer-haul markets.

“If we get access to Europe, we are going to transfer [our model] from point-to-point to network airline,” he confirmed. “And if we change our operation to network, I think we will have an opportunity to bring widebody aircraft – especially for long-haul like Malaysia or Far Asia. And we can use it also for Hajj and Umrah.”

Frankfurt and Amsterdam are the first European targets, potentially followed later on by Paris and London. The entire continent is within reach of Fly Baghdad’s 737-900ERs.

Not so for the Asia Pacific network, however, which would also include Indonesia and Thailand. Management has, therefore, set their sights on a pair of Airbus A330s: “One as a backup [aircraft] in case we have some operational issues, and one to be operated.”

Several caveats are attached to the project. Fly Baghdad’s primary target in Asia, Kuala Lumpur, has long been on the company’s wishlist, but efforts to secure a designation on the bilateral agreement between Iraq and Malaysia have, so far, been fruitless.

Even if the widebody operation proves successful, Al-Shabbani downplays the prospect of Baghdad International Airport competing for transfer traffic with the Gulf mega-hubs – something Al-Khafaji had wanted to see happen.

Fly Baghdad also isn’t keen on abandoning point-to-point services in order to funnel traffic through its home base – an approach deemed necessary by many network carriers.

“I will keep [the Najaf and Erbil bases] because the passengers have a desire to travel from their own airport,” Al-Shabbani insisted.

The cost and complexity of securing visas is yet another hurdle on the path to long-haul expansion. “Still the visa is the main burden for the Iraqi people,” he said. “It’s not easy. Iraqis are limited where they can travel, and that has limited our capacity for growth.”

By far the biggest challenge, though, is gaining access to Europe in the first place.

Stay up to date

Subscribe to the free Times Aerospace newsletter and receive the latest content every week. We'll never share your email address.