Africa-Europe routes can play key role for Air Algérie

Before the pandemic, there were plans for Air Algérie to spend $2 billion on new aircraft. Now, as Vincent Chappard reports, the carrier is struggling for its very survival.

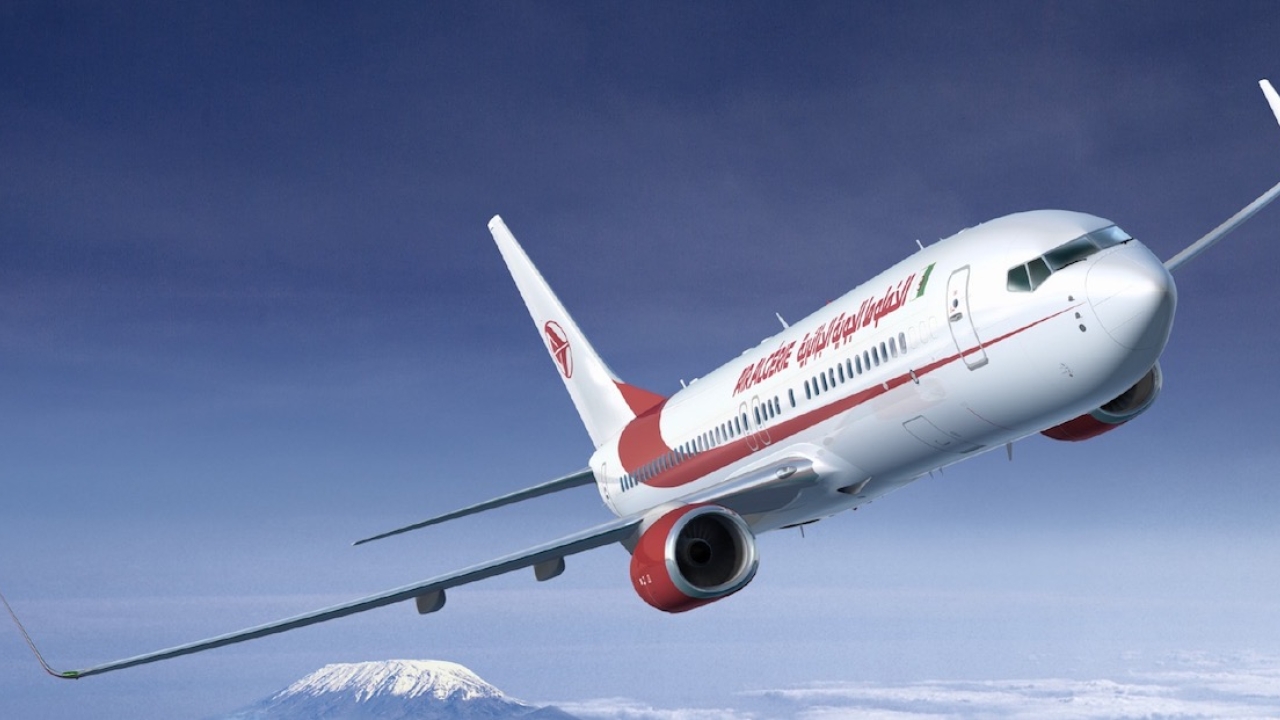

Back in the sky: Air Algérie is gradually increasing its flight numbers. Picture Air Algérie.

Air Algérie increased its flights from nine to 32 per week in September. It was one small step that might mean there’s light at the end of the tunnel.

Even so, the national carrier is currently operating just 7% of its network compared to the pre-Covid-19 period.

In March 2020, at the start of the pandemic, the Algerian authorities took the decision to nail the airline’s aircraft to the ground.

The carrier did manage to carry out repatriation flights for Algerians stranded around the world and even operated destinations it had never flown before, including India, Malaysia and the US.

Borders reopened partially in June, enabling Air Algérie to resume its international operations with nine weekly flights to Tunisia, France, Spain and Germany. Since then, the airline’s spokesperson, Amine Andaloussi, said: “We strengthened our flight programme on September 1 with 32 flights per week operated with A330s.”

The programme, which is established in collaboration with Algeria’s ministry of health and public authorities, depends very much on the health situation locally, as well as in the countries being served.

According to Andaloussi, despite financial difficulties, Air Algérie was on an upward curve before the Covid-19 crisis. It carried more than 6.5 million passengers in 2018 and registered growth in 2019.

“We had a very ambitious programme for 2020 with a $2 billion project to acquire 30 aircraft,” he said.

Air Algérie had also regained market share, particularly between Algeria and France when Aigle Azur (which held 28% market share) went out of business. France remains a strategic market due to a large Algerian diaspora established in the country.

Andaloussi said that the main challenge today is to preserve the national company and help it regain a good financial health. “The Covid-19 crisis has strongly disrupted our vision of the market and gives little visibility. No company today is able to make reliable forecasts,” he said.

“Many parameters are disrupting our studies and projections, including restrictions in countries in Europe and North America, and the recognition of vaccines.”

He added that it was very hard to manage this “stop and go” situation.

Air Algérie needs state support to deal with operational emergencies. With its cash flow in the red, it recorded a $290 million (80 billion dinars) debt during the first year of the Covid-19 crisis.

According to several sources, the new Algerian Minister for Transport, Aissa Bekay, and acting Air Algérie director-general, Amine Mesraoua, commissioned a study from specialist consultant, Mahmoud Mahali, for a recovery plan. It recommended, among other things, increasing its services; improving its distribution model by integrating electronic tickets and online sales; improving its competitiveness; better management; and even lowering ticket prices, which act as a hindrance to the Algerian diaspora seeking to travel.

While Algeria seems to be prepared to gradually open its skies to private companies, Air Algérie has a crucial role to play. It must seize the opportunities offered by this new chapter in air transport development between Africa and Europe, in particular.

There is a need to balance the power relationship between African and European airlines on this market.

Many Algerian and non-Algerian actors are positioning themselves on the Algeria market. Fly Westaf, for example, recently announced that it will soon operate to France from Tamanrasset. The 100% Algerian low-cost airline wants to support the tourism sector through cheap flights.

Even if the European or Middle Eastern companies already present in north Africa are in the process of rethinking or rebuilding their regional network, they are nevertheless keeping a close eye on the Algerian market.

Stay up to date

Subscribe to the free Times Aerospace newsletter and receive the latest content every week. We'll never share your email address.